The Immediate Provision of Information will enter into force in the Canary islands next January 1, 2019.

- The Canary Islands ministry of Finance will launch the Inmediate Provision of Information from de 1st January 2019.

- The sending of detailed invoice records may be done immediately through the platform

The immediate provision of information entered into force, at State level, last July 1st, 2017.

In the Canary Islands, the implementation of the immediate provision of information is expected for January 1st, 2019. Through this system, entrepreneurs and professionals will be able to send detailed invoicing records immediately through the electronic Headquarters of the Canaria islands Tax Agency. It will be mandatory for those who meet the following requirements:

- Large entreprises that are required to declare monthly VAT for turnover exceeding 6.010.121,04€

- Companies registered on the system for Monthly Refunds of VAT.

- Companies under the Regime for Special Group Entities.

On a completely voluntary basis, any company can join the voluntary use of the SII.

∴ Related Services: Factura electrónica

How does the SII work?

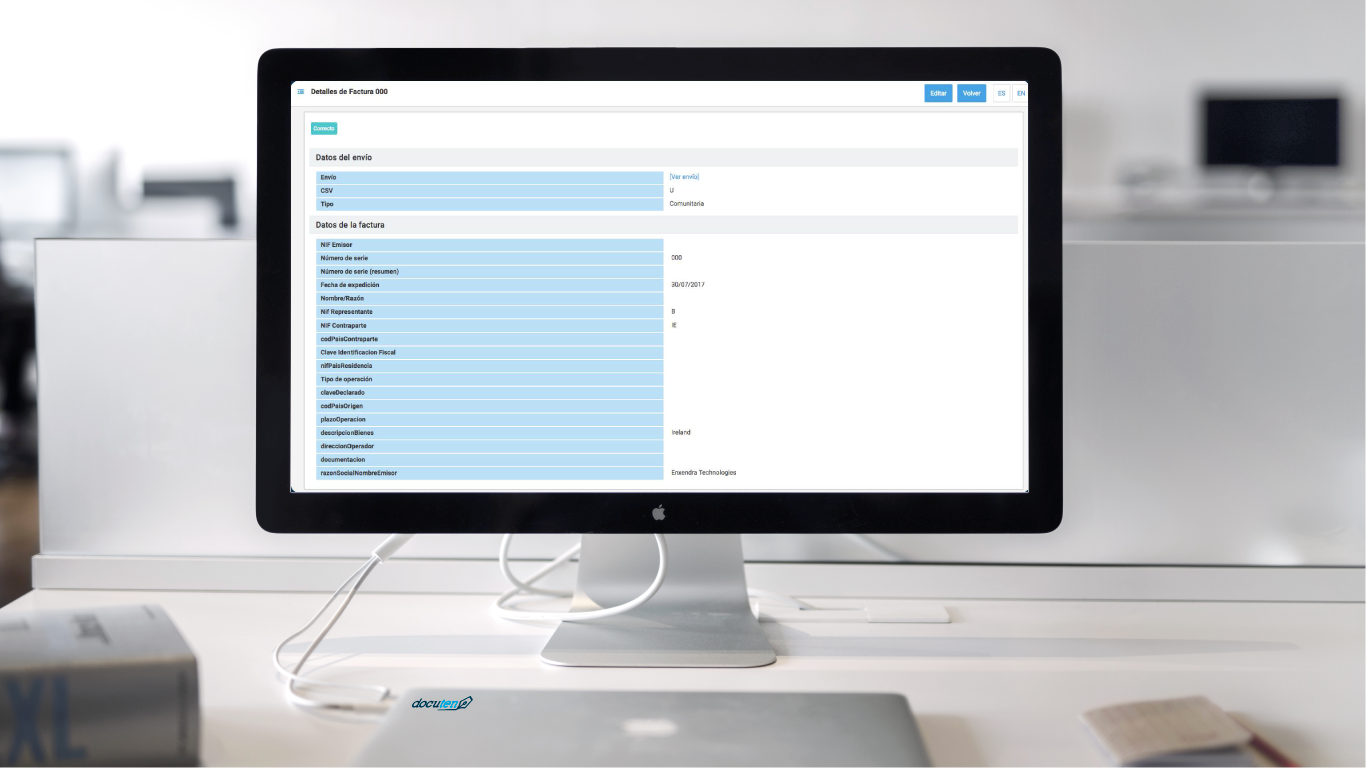

Companies that fulfill the aforementioned requirements must send the data of the invoicing records of the Registration Books required by the regulations of the General Indirect Canarian Tax (IGIC) to the electronic headquarters of the Canary Islands Tax Agency within a maximum period of 4 working days.

Although many of the technical specifications have not yet been clarified, the standard XML format has been defined for the exchange of information with the SII.

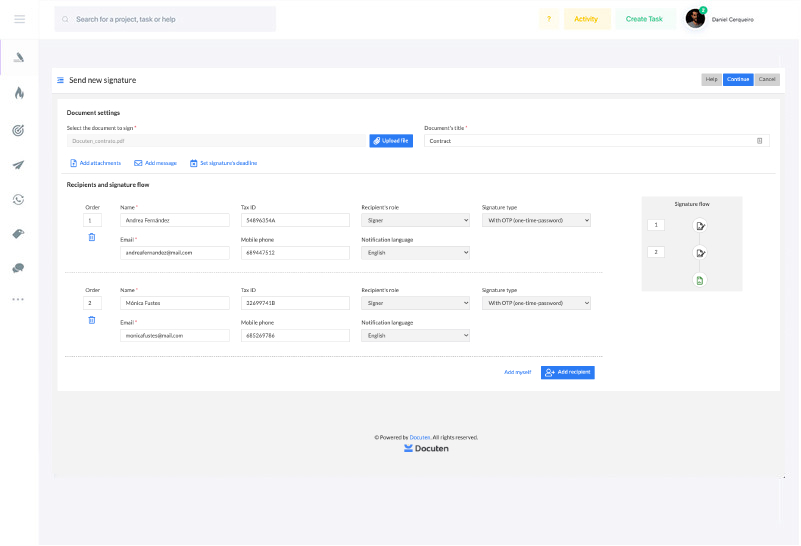

The integration with the Immediate Provision of Information through a Provider of invoicing Services it will be simple and also allow to know the status of the dispatch thanks to the issuance of this information by the Canary Islands Tax Agency.

The solution of Docuten

Enxendra Technologies, with its platform of e-invoicing and digital signature, Docuten, offers a solution for easy integration with the immediate provision of information.

- It adapts to you: choose the format and channel that best fits.

- It ensures your dispatch: with an SLA of 99.99% Enxendra guarantees the service for the dispatch to the Canary Islands Tax Agency.

- Multiple possibilities of integration: API Rest, sFTP, or AS2.

Advantages of working with Docuten

- It features technical consultancy for the compliance with an adequacy of the solution.

- With more than 9 years of experience in digital electronic invoicing and project implementation solutions, we guarantee a safe and validated solution.

- Our experience in the SII supports us. More than 10 million invoices have been sent by our solution to the AEAT, in a satisfactory manner.

For any unresolved questions regarding this, please contact our customer service. We will be glad to help you! You may also be interested in:

También te puede interesar: