Nothing stops your business with Docuten Bundle Cloud

Digital Signature | Electronic Invoicing

ADMINISTRATIVE DIGITALISATION

Our products, our value proposition

A single provider for the complete digitalisation of your administrative processes. Centralise digital signature and electronic invoicing, and payments.

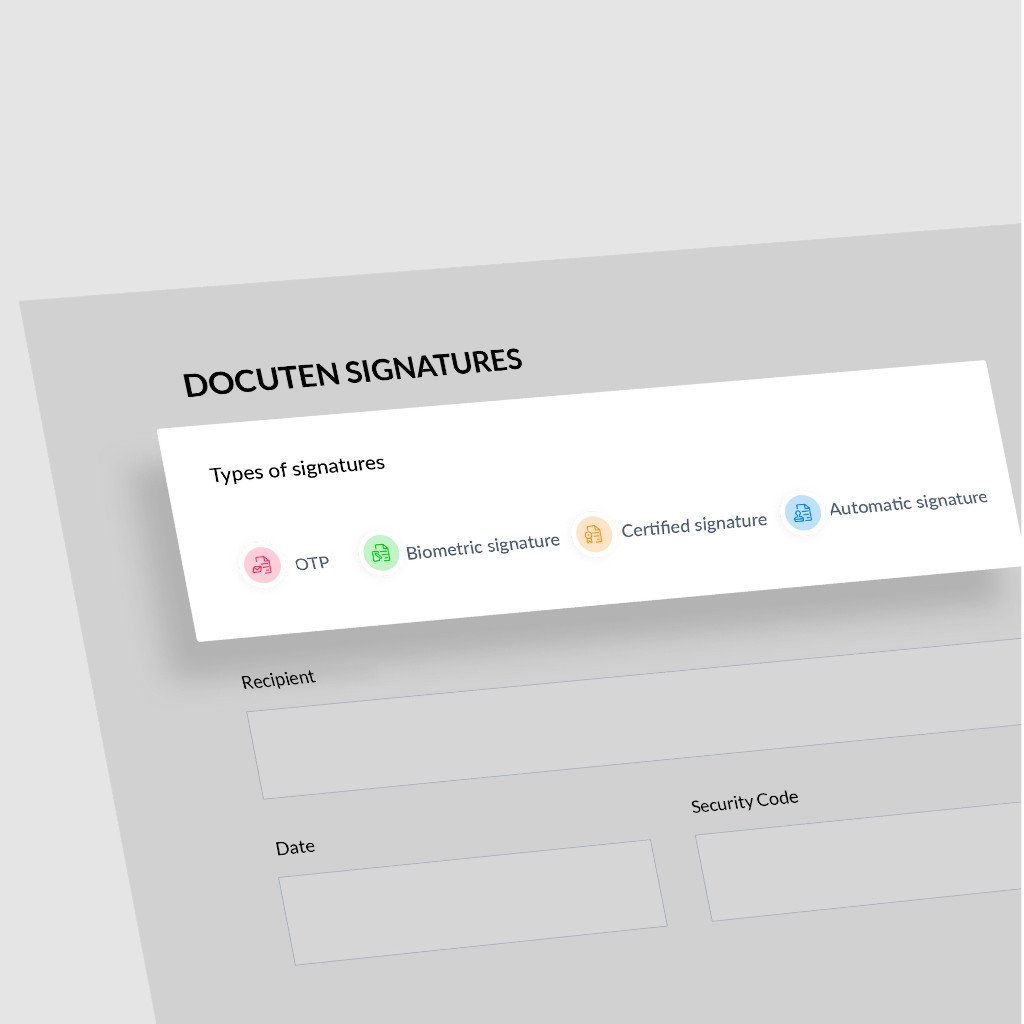

Sign documents digitally with maximum legal guarantees

Docuten offers all the types of signatures included in the eIDAS Regulation.

Docuten is recognised as a Qualified Trust Service Provider (QTSP), in accordance with Regulation (EU) No 910/2014 regarding electronic identification and trust services for electronic transactions (eIDAS).

Digitise your incoming and outgoing invoices.

GET INTEGRATED

By developers, for developers

Achieve maximum operational efficiency by integrating your systems with Docuten. Our APIs allow us to connect with your company tools or any business software.

Digitalisation

Benefits for your company

The digitalisation of your administrative processes will give your business a clear competitive advantage: greater efficiency, more security, increased sustainability and compliance with all legal standards.

01

01Save money

Implement our digital solutions to save your company money. Put an end to tedious administrative paperwork, and avoid unnecessary expenses.

02

02Save time and reduce errors

More informationBy integrating our technologies into your administrative processes, day-to-day human error is drastically reduced and your team no longer has to waste energy on time-consuming tasks.

03

03Compliance

More informationAt Docuten we provide you with the necessary legal support, complying with all current regulations that affect digital signature, electronic invoicing and direct debit management.

04

04Sustainable

For every 1000 sheets of paper you’re not using, you’re saving:

- 0,66 kg of C02

- 9 kg of wood

- 10.000 litres of water

05

05Secure

Your documents are in good hands with Docuten. We comply with the strictest security regulations so you can rest easy.

Docuten has the Information Security Certificate based on the requirements established by the international standard ISO 27001, the highest guarantee of security.

DIGITALISATION

Benefits for your stakeholders

Digitalisation of processes increases satisfaction and enhances loyalty, improving the experience of your stakeholders.

More work flexibility

Less time dedicated to work that doesn’t directly generate profit

Access documents easily and dependably

Improved stakeholder trust

![]() Save up to 80% with Docuten Discover how

Save up to 80% with Docuten Discover how ![]()

GLOBAL LEGAL COVERAGE

Potential to operate globally

Docuten offers global legal compliance for your digital signature processes, the sending and receiving of invoices and direct debit management, all through a single platform.

MORE THAN

M

Invoices processed

MORE THAN

M

Documents signed

ADAPTED TO YOU

Equipped to digitalise different industries

At Docuten we understand that different industries and different companies have diverse needs. Our services adapt to the specificities of your industry and the particularities of your company to optimise your business operations.

Want more information about Docuten? Contact us ![]()

WE ARE HERE TO HELP

Resources for your digital transformation

At Docuten, we’re by your side at every stage of the digitalisation process. From implementation and onboarding to integration and training, you’re supported with the resources you need.

STAY UPDATED

Subscribe to our Newsletter

Get the latest on innovation and technology, interviews, our platform, digitisation tools and more.

“The cure for boredom is curiosity.” -Dorothy Parker

LASTEST PUBLICATIONS

Visit our blog

Docuten has more than 10 years of experience in digital signature, electronic invoicing and direct debit services.

Don’t hesitate to contact us with any questions about Docuten. You can also visit our FAQs page!